Solar panel grants in the UK: Your guide to government funding options & schemes

Did you know that there are often solar panel grants and incentives available that can cover a significant portion of your solar panel installation costs? Navigating these opportunities can feel like discovering a hidden treasure chest. If you’ve been eyeing solar panels but hesitating due to the cost, understanding available solar panel grants and funding options could make all the difference.

Many homeowners want to switch to solar energy but are deterred by the upfront expense. Fortunately, various solar panel grants can ease the financial burden and make renewable energy more accessible. But how do you find these solar panel grants, and which ones are right for you?

On this page, you’ll learn:

- The types of solar panel grants and incentives available in the UK.

- How to apply for these grants and what eligibility criteria you need to meet.

- Tips for maximising your financial benefits and ensuring a smooth installation process.

By the end of this page, you’ll know exactly where to look for solar panel grants and how to take advantage of them to get a more affordable solar PV system setup for your roof.

Let’s get started!

- Introduction to solar panel grants

- Overview: Government Solar panel grants and solar panel funding schemes in the UK

- Solar panel grants and schemes available in the UK

- Alternative funding options & schemes for solar panels

- Regional grants and schemes

- Cost of solar panels with government grants

- Solar panel grants FAQs

- Final thoughts

Introduction to solar panel grants

What are solar panel grants and how do they work?

Solar panel grants are financial incentives provided by the UK government and the local authority to encourage the use of renewable energy sources, specifically solar power.

The goal of these grants is to reduce the upfront costs that come with installing the panels, so it can be reasonably more affordable for homeowners and businesses to make the switch to green energy. The UK government continues to show its commitment to reducing carbon emissions and improving energy efficiency.

In a broad sense, solar panel grants are part of the effort to meet the national goal of achieving net-zero carbon emissions by 2050. These grants are making solar more accessible, helping households cut electricity bills, reduce their carbon footprint, and give them a brighter, more sustainable future.

Here’s how solar panel grants work:

- Lowering the cost of solar panels: Grants cover part or, in some cases, all of the installation costs for solar panel systems.

- Encouraging renewable energy adoption: These financial incentives make solar energy more attractive for those who might find the initial cost a barrier.

- Part of the UK’s green agenda: Solar panel grants are a crucial tool for meeting the UK’s renewable energy targets.

Benefits of solar panel grants for renewable energy

Solar panel grants provide many benefits beyond just immediate cost savings on your energy bill:

- Increased energy efficiency: Solar panel grants often come as part of wider initiatives put forward by the government to make households more energy-efficient overall.

- Supporting UK’s climate goals: As mentioned, such grants are part of the UK’s roadmap in achieving net-zero carbon emissions by 2050 since their premise is on fostering an increased number of homes producing renewable energy.

- Long-term savings: Government grants make the return on investment of solar panels even more lucrative. Over the system’s lifetime (often 25 years or more), households can save thousands of pounds in energy costs.

When looking at the incredible benefits you can get from renewable energy grants, it’s also equally important to make a well-rounded decision about solar. Be sure to read our article on the pros and cons of solar panels to learn more.

Solar panel Grants vs Schemes: What are the key differences?

It’s easy to confuse solar panel grants with other solar schemes. While both help when you wish to install solar panels, they work in very different ways:

- Solar Panel Grants: These are financial aids that directly reduce the initial cost of installation. The UK government provides various grants for different groups, such as low-income households or homes with poor energy efficiency ratings.

- Solar Schemes: Normally, these tend to focus more on indirect financial support. For example, the Smart Export Guarantee (SEG) allows you to earn money by selling the surplus energy your solar panels produce back to the national grid.

DID YOU KNOW… Did you know that solar panel grants are direct financial aids from the UK government, while schemes offer indirect financial support?

It’s important to understand these differences, as they’ll help you find the right option for your home throughout its solar journey. In the sections that follow, we’ll go over both the grants and schemes available:

Overview: Government Solar panel grants and solar panel funding schemes in the UK

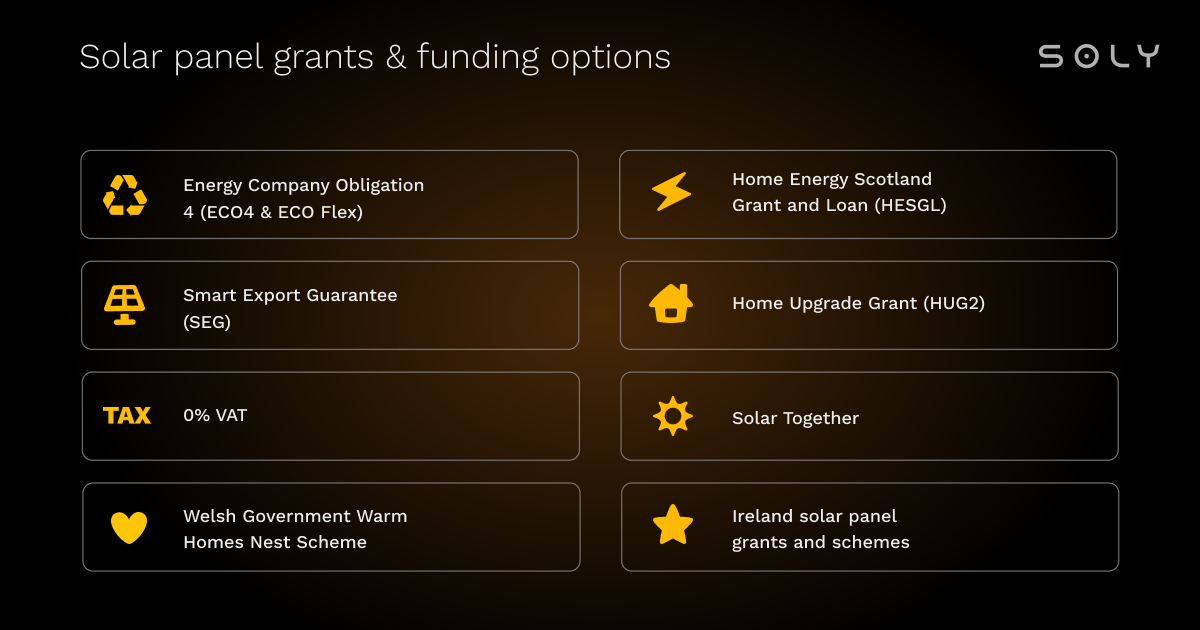

Here’s a brief overview of some key solar panel grants and schemes available across the UK:

- Government grants for solar panels in the UK

These grants below have the goal of alleviating the initial cost of a solar panel installation:

- ECO4: This grant provides funding for energy-efficient upgrades, including PV panels. It’s aimed at low-income and vulnerable households.

- ECO Flex: This grant allows local authorities to refer more homes in need and extend the ECO4 eligibility.

- Home Upgrade Grant (HUG2): Offers up to £10,000 for households off the gas grid to assist with solar installations and energy-efficient improvements.

- Alternative solar-specific grant schemes in the UK

These schemes provide benefits that go beyond the help simple grant:

- Solar Together: This is a group-buying scheme that allows communities to purchase the panels at reduced costs.

- 0% VAT on Solar Panels: With this solar-specific grant scheme, homeowners pay no VAT on solar panels until 2027, reducing installation costs.

- Smart Export Guarantee (SEG): Allows homeowners to earn money by selling excess energy back to the grid. This is the only scheme currently open to new applications, replacing the Feed-in Tariff (FiT) scheme which closed in 2019.

- Other Regional Grants and Schemes

In the UK, different regions offer other grants and schemes tailored to them such as:

- Home Energy Scotland Grant and Loan ( HESGL): This is a Scottish government program that offers grants and interest-free loans or a combination of both. It allows installing energy saving materials and clean heating systems.

- Welsh Government Warm Homes Nest Scheme: The focus of this scheme is on making Welsh homes more energy efficient. It’s primarily aimed at low-income households and those that already receive certain government benefits.

- Ireland solar panel grants and schemes: This includes the Solar Electricity Grant (SEAI). It provides up to €2,100 to eligible homeowners and helps cover the costs of installing a PV panel system.

Of course, each of these grants has its own eligibility criteria and benefits. Applying for these incentives isn’t always a straightforward process. However, understanding each can make the process much easier.

Below, we’re going to help you understand these grants a little better:

Solar panel grants and schemes available in the UK

The ECO4 is designed to help lower-income households in the UK improve their home’s energy efficiency with funding for upgrades. This includes installing PV panels. This initiative is part of the broader efforts to reduce energy consumption and promote sustainability across the nation.

- What does the grant cover?: It covers up to 100 per cent of solar panel installation costs

- How long does this grant run for?: The application deadline is March 2026

- Where is this grant available?: The ECO4 grant is available in England, Scotland, and Wales. It is currently unavailable in Northern Ireland.

- How do I get paid?: If approved, the grant pays the installers. If it doesn’t cover the full cost, you’ll pay the rest or use financing. Typically, the grant covers all upfront costs.

Who is eligible for ECO4?

- Households must receive certain benefits like the Universal Credit or Pension Credit to qualify.

- This scheme is for low-income, fuel-poor, and vulnerable households.

- Eligibility is based on the Energy Performance Certificate (EPC) rating of your home, not on the age of the property.

How to apply for ECO4

- To apply for the ECO4 scheme, contact a participating energy supplier, such as British Gas, EDF Energy, or E.ON.

- The energy supplier will assess your eligibility and provide guidance on the application process.

Quick-start solar grant checklist for ECO4

Application Checklist

- Documentation: Have your council tax bill, ID, proof of income (under £31,000), and benefits consent form ready.

- Form Accuracy: Double-check spelling of your name to avoid delays.

Approval Process

- Benefits Verification: Arrange a survey after benefits verification, often within a week.

- LA Flex: Approval might take longer compared to the ECO4 application.

Grant Amount

- Funding: Varies by project, from single-measure installations to comprehensive upgrades.

- Project Scale: Large projects can receive over £80,000 for multiple energy-efficiency improvements.

Installation

- Timing: Schedule installation after grant approval and work agreement, usually within a week.

ECO Flex

The ECO Flex scheme is part of the ECO4 initiative. It’s designed to expand eligibility for funding by giving local authorities the opportunity to refer households they identify as being in need of energy efficiency improvements.

Differences from ECO4:

- Extended Eligibility: ECO Flex targets additional households that may not meet the general criteria but are considered vulnerable by their local authorities.

- Local Authority Referrals: Applications can be initiated based on referrals from a local authority, further facilitating access beyond those receiving any particular benefit.

Home Upgrade Grant (HUG2)

The HUG2 is a grant that aims to support energy efficiency improvements in homes that are off the gas grid in England. It’s very beneficial for making homes warmer and much more cost-effective to heat them.

- What does the grant cover?: The average grant amount is around £10,000 per approved grant and covers energy-efficient home improvements with solar PV panels, insulation, and low-carbon heating.

- How long does this grant run for?: Until March of 2025

- Where is this grant available?: in 45 local authorities across England

- How do I get paid?: You can apply at the HUG2 website.

Who is eligible for HUG2

To be eligible for the HUG2 renewable heat incentive, you must be a homeowner or private tenant. You should not use mains gas for heating and the home must have an energy efficiency rating of D, E, F, or G. Additionally, eligible postcodes and additional income or benefit criteria must be met, as specified by your local authority.

How to apply for HUG2

To apply for the HUG2 energy efficiency measures, check if your local council offers the scheme. Then, if you’re eligible, you can apply directly through your local council’s website. Afterwards, the council will arrange a home survey to assess your energy efficiency needs.

Quick-start solar grant checklist for HUG2

- Identification Documents: Such as a valid driver’s licence or passport.

- Proof of Address: Council tax statement or recent utility bill

- Energy Bills: Any recent bills to show your current energy use.

- Proof of Income or Benefits: Recent bank statements or letters confirming benefits you receive.

- Proof of Ownership or Tenancy: Includes mortgage statements, property deeds, or rental agreements.

- Property Information: Information like an Energy Performance Certificate (EPC)

Alternative funding options & schemes for solar panels

Zero VAT on solar panels

The Zero VAT on solar panels is an excellent offering that allows homeowners to install solar PV panels by eliminating the VAT on these purchases until the year 2027.

With the 0 rate energy savings, instead of the 20% VAT reg, homeowners can save up to £2,850 on the total installation cost of a typical 4kW solar panel system.

- What does the VAT cover?:The 0% VAT rate applies to the purchase of solar panels and the cost of their installation.

- How long does the VAT run for?: Until 31 March 2027.

- Where is this available?: England, Scotland, Wales, and Northern Ireland

- How to sign up?: You don’t need to apply for the 0% VAT on panels in the UK for residential properties because it’s automatically applied.

Who is eligible for 0% VAT?

The 0% VAT rate is available to all homeowners, regardless of income or property type. However, it’s important to keep in mind that the rate will return to 5% at the end of March 2027.

Solar Together Scheme

Solar Together is an innovative community buying program that lets homeowners and tenants save on solar panel and battery storage by buying in bulk. Group purchasing through this scheme is used to negotiate significant discounts, facilitated by iChoosr, an expert in orchestrating collective buying initiatives.

- What does the grant cover?: Solar Together offered discounts on the installation of solar panels and battery storage.

- How long does Solar Together run for?: With Solar Together, closing dates vary and depend on local authorities.

- Where is this grant available?: iChoosr, who collaborates with local authorities to roll out these schemes, has been available in various regions of the UK since its inception in 2015.

- How to sign up?: Joining this scheme involves registering online and providing property details, participating in a reverse auction where solar suppliers bid to offer the lowest prices.

Smart Export Guarantee (SEG)

SEG is an exciting scheme introduced in the UK in 2020. It reimburses low-carbon, small-scale electricity generators for excess energy exported back to the national grid.

- What does the grant cover?: SEG covers electricity generated from various renewable sources such as solar PV, wind, micro-CHP, hydro, and anaerobic digestion.

- How long does this grant run for?: SEG varies in length. Some suppliers offer 12-month contracts.

- Where is this grant available?: The SEG is available in England, Scotland, and Wales.

- How do I get paid?: First, sign up to an SEG tariff with a licensed electricity supplier; then provide initial metre readings and subsequent quarterly metre readings. Payments are made quarterly.

Who is eligible for SEG?

The Smart Export Guarantee scheme applies to all owners of solar panel systems that have a capacity of up to 5 MW. There is, however, an important prerequisite for this. To participate, the property must be fitted with a smart metre that’s capable of accurately measuring the amount of energy fed back into the grid.

Regional grants and schemes

Scotland: HESGL

The Home Energy Scotland Grant and Loan Scheme is specifically designed to offer incentives to households in Scotland in their quest to make their homes more energy-efficient.

- What does the grant cover?: Funding and interest-free loans for energy saving materials including solar panel installations, insulation, and more efficient heating systems.

- How long does this grant run for?: Duration varies. Contact current details from Home Energy Scotland.

- Where is this grant available?: Across Scotland.

- How to apply for HESGL: Contact Home Energy Scotland at 0808 808 2282. Customer service is available from 8am to 8pm Monday to Friday and 9am to 5pm on Saturday.

Who is eligible for HESGL?

Applicant households need to demonstrate low-income fuel poverty or vulnerability and have a low energy performance rating.

Wales: NEST Scheme

The Welsh Government Warm Homes (NEST) scheme is designed to help households in Wales. It’s particularly for those who are vulnerable due to financial or social circumstances and allows them to improve the energy efficiency of their home.

Eligibility requirements

Available to low income households experiencing fuel poverty or low energy ratings.

How to apply

For application details and to check if you are eligible, telephone the Nest support team on 0808 808 2244. Lines are open Monday to Friday, 9.00am to 6.00pm.

Quick-start solar grant checklist

Along with your application, you’ll need to include:

- For Homeowners: Mortgage statement, home insurance policy, and property deeds.

- For Private Tenants: Landlord’s details.

- Proof of Means-Tested Benefits: Documentation of any benefits you receive.

Northern Ireland schemes & grants

There are no domestic grants available presently that target the installation of solar panels in Northern Ireland. However, there may be other energy efficiency schemes to which a householder may be entitled – for example, insulation and heating upgrading – that could all help reduce energy costs.

There are currently no direct incentives available to encourage households, but the SEAI does offer a Solar Electricity Grant, which gives a maximum of up to €2,100 to eligible home-owners towards the cost of PV panel installations. This grant is available for properties in Northern Ireland to help the solar panel system cost.

For businesses, there is funding available that covers up to 20% of the cost of installing solar panels. This aims to encourage commercial adoption of renewable energy in the region.

Although domestic grants are minimal at this point, it is recommended that homeowners look into broader energy efficiency programs that might indirectly support the adoption of solar energy.

Cost of solar panels with government grants

How much do solar panels cost with a government grant?

With a grant from the government, prices for a 3.5kW solar panel system can be in the range of £6,000 to £8,000, though in many instances is much lower, based on the particular grant and the pricing by the installer.

Can I get free solar panels in the UK?

Yes, the UK government and other local bodies have schemes in place, and grants that may help with solar panels being fully paid for in qualifying homes. These programs are designed to make homes more energy-efficient and lower energy bills.

Generally, qualification into these programs is income-based, on household income and the type of government benefits currently received. If you meet the specific criteria, you could potentially receive solar panels as part of a broader package of home improvements.

Solar Panel Grants FAQs

What is solar panel funding?

Solar panel funding can be described as government or other entities’ means of financing individuals to reduce the cost of the installation of solar panels in the form of grants, loans, or rebates that reduce the initial costs.

What are the advantages of a grant?

Grants for solar panels are beneficial because they:

- Reduce upfront costs: You don’t have to pay the full price for installation.

- Increase accessibility: Grants allow more people to afford solar technology.

- Encourage renewable energy adoption: This supports the UK’s environmental goals.

Do you still get a grant for solar panels?

Yes, there are still solar grants available for solar panels in the UK, such as the ECO4 and the HUG2. The ECO4 is set to expire in March 2026 and the HUG2 will be available until March 2025.

Who qualifies for solar panel funding?

Eligibility will vary by the scheme but typically includes:

- Households with low income or receiving certain benefits.

- Properties that need energy efficiency improvements.

- Locations where specific grants are targeted.

How do I qualify for free solar panels in the UK?

You can receive free solar panels in schemes related either to low-income homes or to those receiving certain benefit-related packages. Generally speaking, you must be eligible in relation to energy assessments or meet certain income requirements, as not all free solar panel grants provide free solar panels.

How does solar funding work?

Solar funding works by either directly financing the installer or rebating financial incentives to the homeowner after installation is complete. This support reduces overall cost and can sometimes cover it in its entirety.

How much can I save with a solar panel grant?

Savings can be tremendous at times, covering the whole installation cost of the unit. Over time, energy bills will decrease and offset the cost of investment with potential savings for long-term periods.

Final thoughts

Solar panel grants in the UK are an essential tool for promoting renewable energy adoption and helping households reduce their energy bills. Schemes like ECO4, the Home Upgrade Grant, and Solar Together provide substantial financial support, making solar panel installation more affordable for low-income and eligible households.

In addition to these schemes, homeowners can benefit from other incentives, such as zero per cent VAT on solar installations and the Smart Export Guarantee (SEG), which offers payments for surplus energy exported back to the national grid.

Regional programs in Scotland, Wales, and Northern Ireland also offer tailored grants and funding options to meet the unique needs of homeowners in those areas. Exploring these options can make going solar more accessible and financially viable for a broader range of people.

Why choose Soly?

- We’re highly rated on TrustPilot and certified as a Which? Trusted Trader.

- We collaborate only with local, reliable installers accredited by HIES, TrustMark, and MCS.

- With over a decade in the industry and over 35,000 satisfied customers, we deliver high-quality installations.

- As solar experts, we understand the local authority flexible eligibility criteria that’s necessary when it comes to grants for solar panels.

- Our solar panels and batteries come with extensive guarantees, ensuring long-term reliability.

- Use our online configurator to estimate your solar needs and potential savings.

Get in touch with Soly today to explore your options for energy-efficient home improvements. Our solar experts can help you determine if you qualify for available schemes and make solar energy an easy, rewarding choice.